Factors influencing the family business succession in Albania

Authors

Brikena Leka

Share

Annotation

Family business has an important role in the economy of a country. For this reason, it is conducted a study for the family businesses in Albania, based on a survey that consists in 327 interviews with micro family businesses. The focus of this study is to identify the main internal factors in the family business that impact the business succession. The Chi-square tests and a linear regression are performed, elaborating the data in SPSS. The succession of the family business is significantly linked with the “age” of business, the number of households involved in the business, the number of households that are employed elsewhere, the households involved in decision-making and the turnover.

Keywords

Authors

Brikena Leka

Share

Introduction: Family business has an indisputable impact on the economy of a country. These businesses employ a large number of employees, family members or not, and provide the basic income for many families. It is known that family businesses can be small or large, but when we speak about countries like Albania (referring the GDP per capita level), family businesses usually mean small and very small (micro) businesses. This is influenced not only by the economic development of the country, but also the fact that family businesses are relatively new. The opportunity for starting family businesses was given after 1990-s. Albania was a country that suffered for about 45 years, the harshest dictatorships of communism, with the total closure of the state borders. During the communism the concept of private property didn’t exist and therefore the possibilities for starting a family business were zero. Many family businesses that existed before the outbreak of the World War II, were nationalised, or closed. The reopening of family businesses started at the beginning of 90-s. The beginning of 90-s found the Albanian people very poor, so the entrepreneurship was conditioned by this level of income, by an almost undeveloped banking and financial system. Therefore, one of the main sources of financing the family business in those years were the funds that were provided by the remittances of immigrants, as well as the financial support of relatives and friends. Financial support of relatives and friend fits with the financial and social culture of our country. Therefore, even nowadays it is one of the main forms of funds used for family business financing. With the development of the banking system, borrowing has become one of the alternative sources of financing. Albania has concentrated most of its businesses in the SME sector, with almost 90% of businesses. Business categorization is based on the number of employees and business turnover. Small Medium Enterprises (SMEs) based on the legislation of the European Union according to the number of employees, are considered enterprises that have less than 250 employees and turnover less than 250 million Albanian Lek (equivalent of approximately 2.1 million euros). The SME-s are categorised as Micro business: up to 9 employees and turnover less than 10 million ALL; Small business: 10-49 employees and turnover less than 50 million ALL; Medium business: 50-249 employees and turnover up to 250 million ALL.

- Related work in business family succession

One of the most discussed issues for family businesses is the transgenerational intense of the business. The possibility to inherit the business to the next generation decreases as it passes from generation to generation. Succession planning is crucial to the success and continuity of a business [9; 11; 12], particularly for family businesses, where few survive more than one generation [2; 6]. It is very difficult for family businesses to succeed in the second and third generation, because of the conflicts created over the years and the problems created as a result of leadership change. So only less than 30 percent of family firms in the United States pass into the second generation [2; 6] and 15 percent to 16 percent survive into the third [10]. The average life expectancy of family firms is estimated to be twenty-four years, which is also equivalent to the average tenure of their founders [1].

- Data and methodological issues

This paper is based on primary data collected by interviewing family businesses. In total, 327 valid questionnaires were completed. The questionnaires are filled out in the capital of Albania, which also has the largest share of businesses in the country. In a previous study for family businesses in Albania [8] found that the link between the initiative to open a family business and the living residency was significant at the 0.05 level favouring individuals who live in the capital city. So, it is justified that the data are representative for the whole country. Meanwhile, the selection was random, but the number collected for each municipality unit was proportional to the population of each unit. The focus of this study has been micro businesses- businesses with up to 10 employees. The data are elaborated in SPSS, since the data were mainly of a qualitative nature. The study consists of two statistical analyses. First, Chi- square tests are performed to analyse the significance of the relationship between some main internal factors of the family business and the possibility for business succession. The Chi-square analyse tests the differences in attitude of groups and categories and in the case that such differences are significant then the conclusions may be generalized for the whole population. Second, a regression equation was performed to analyse the main internal factors in the family business (used as independent variables) that determine the tendency to inherit or not the business to the successor (the succession decision used as dependent variable).

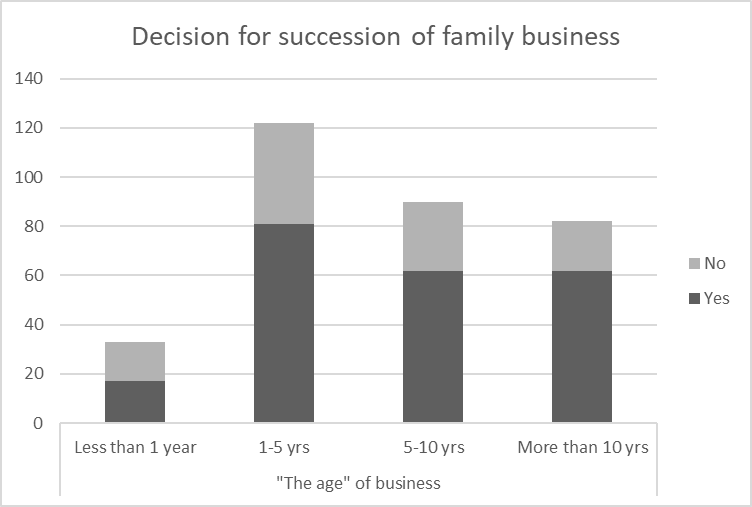

The first relation (link) to be examined is the one between the decision to inherit the business or not and the years that the family business has been operating in the market (“the age” of the business). As it can be seen from the graph below, the older the business is in the market, the higher the probability that the owner has a clear plan to inherit it.

Source: Author’s calculation

To make a more accurate analysis of the link that exists between these two variables, we also use the Chi Square test, so if the link is statistically significant, the conclusion reached for our study can be generalized for all family businesses that operate in Albania. The value of Chi-square is 6.648, for 3 degrees of freedom, and the significance is 0.091, so less than 10%, meaning that this link is statistically significant.

Person Chi- Square Test

|

|

Business “Age” |

|

|

Do you plan to success your business? |

Chi Square |

6.648 |

|

|

Df |

3 |

|

|

Significance |

0.091 |

Source: Author’s calculation

So: X2 (3, N=327) = 6.648 p<0.091

The analysis of frequencies and the Chi-square test lead to the conclusion that the relationship between the decision-making for the transfer of the family business and “the age” of the business is important. As the years of business activity pass, the predisposition to inherit the business increases. This is to be expected, since the longer a business is on the market, this means that they have successfully faced many challenges, have increased (expanded), better risk management, so the plans for business’s succession are more clearly.

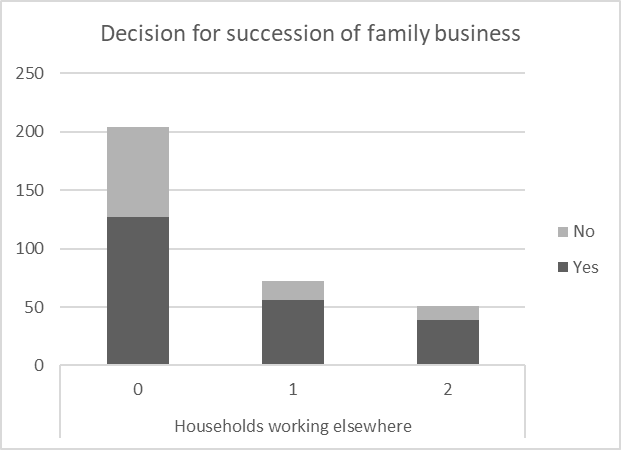

Another analysis is about the connection between the decision to success the business and the number of family members involved in the business (presented in the first graph below) as well as the decision to inherit the business and the number of family members employed outside the business, although they were involved somehow in the family business as well (presented in the second graph below).

More predisposed to success the business are the owners of businesses where there are more people from the family involved in the family business and more people who work outside the business, but it has to be mentioned that the weight in the first case is higher. In the first case, there is more commitment from the family members in the business, thus a greater contribution. Being part of the decision-making in this business, the chances of planning to inherit the business to them are greater. The transfer of the business to the heirs comes naturally and without financial and social problems, as they know the business activity very well. Meanwhile, even in the case when there are more family members employed outside the business, but who are involved in the family business as well, their experience, acquaintances, income are factors that positively affect the decision-making in the business and consequently also in the succession.

Source: Author’s calculation

This analysis was also completed with the analysis of the Chi-Square Test and for both variables taken in the study, the importance of the connection was very high. So, the plan to inherit the business is directly related to the number of households involved in this business and the number of households who are employed elsewhere, but who are also involved in the family business.

The results of Person Chi Square test for the first case:

X2 (3, N=327) = 18.150 p<0.001

The results of Person Chi Square test for the second case:

X2 (2, N=327) = 7.923 p<0.019

The link between the decision to succeed the business and the decision-making process in the business is analysed. The more family members are involved in decision-making, the higher is the probability that this business will be inherited. Being part of the decision-making process makes the younger members of the family more responsible for the business activity and its activity. They learn and recognize the difficulties that the business faces, the competitive abilities of their business and later it is much easier to manage the business and expand the activity of this business.

Source: Author’s calculation

The results of Person Chi Square test:

X2 (2, N=327) = 11.095 p<0.004

This connection is also statistically very important, if we refer to the results of the Chi-Square Test, so we can conclude that planning to inherit the business is much more present in businesses where other family members are engaged in the decision-making.

In the end, the link between the decision to succeed the business and business gross turnover was analysed. The data are in Albanian Lek (ALL) and the equivalence in euros for each category is approximately: Less than €17,000; €17,000-€42,000; more than €42,000. As it can be seen from the graph, the higher the turnover, the greater the probability that the business will be inherited to the next generation. Businesses with higher turnover mean more consolidated businesses, where the planning and decision-making process is of greater importance. Therefore, many decisions are made for the future of the business, one of which is the decision related to succession.

The Chi-square test verifies the above relationship, with a very high level of statistical significance. This means that planning to inherit the business is very high in businesses with higher turnover. It should be kept in mind that the focus group of this study is micro businesses, with 1-10 employees.

The results of Person Chi Square test:

X2 (2, N=327) = 16.288 p<0.001

The above factors and some other factors related to the company were taken into consideration as independent variables to explain the Decision for Succession, as a dependent variable. The linear regression is performed as follows:

Results of testing the determinants of the Decision for Succession

|

Depended Variable |

Decision for Succession |

|

|

Independent Variable |

Coefficients |

Probability |

|

Gross turnover |

-13.8*** |

<0.001 |

|

Households involved in business |

-0.065* |

0.06 |

|

Households involved elsewhere |

-0.074 |

0.029 |

|

Decision making |

0.06** |

0.045 |

|

Reason for starting a family business |

-0.039* |

0.061 |

|

R-squared |

0.102 |

<0.001 |

|

Durbin Watson |

1.85 |

|

Source: Author’ calculations

Notes: :***, **, * denote statistical significance at the 1, 5, 10 percent level respectively

The equation of regression is:

Succession decision = 1.656 - 13.8*Turnover - 0.065*H_B - 0.074*H_O+0.06*Decision-0.039*Reason

It means that with high significance, the decision for succession of the business is connected with the gross turnover of the company (the higher the turnover, the less chance of non-succession); households involved in the business (higher the number, less possibility for non-succession); households involved elsewhere, although involved in the family business (higher the number, less possibility for non-succession);decision-making (less households involved in the business, higher possibility for non-succession); reason for starting a family business (if the reasons are connected with being an owner and not an employer, as well as to have a business to look after during the retirement, will increase the probability for succession of the this business). The R squared is not too high, but it is taken in consideration only factors connected with the family, and not factors connected with the macroeconomic situation of the country. Meanwhile the Durbin Watson is 1.85, which is a good value being between 1.5-2.5; and the significance of this regression is high (<0.001), which means that this model is a good one.

Main findings

One of the most discussed issues of family business is also the problem of succession. Thus, in this study for the family business in Albania, several Chi-Square tests and a regression equation were performed to explain which are the main internal factors in a family business, which impact the decision-making to inherit or not the business in future generations. Based on the Chi-Square tests, it was found that there is a very strong relationship between the “age” of business, the number of households involved in the business, the number of households that are employed elsewhere, the households involved in decision-making and the turnover. Meanwhile through linear regression is found that with high significance, the decision for succession of the business is connected with the gross turnover of the company (the higher the turnover, the less chance of non-succession); households involved in the business (higher the number, less possibility for non-succession); households involved elsewhere, although involved in the family business (higher the number, less possibility for non-succession);decision-making (less households involved in the business, higher possibility for non-succession); reason for starting a family business (if the reasons are connected with being an owner and not an employer, as well as to have a business to look after during the retirement, will increase the probability for succession of the this business).

References:

References:

- Beckhard, R., & Dyer, W. G., Jr. Managing continuity in contracting process. Journal of Law and Economics, 21: 297-326. 1983

- Birley, S. Succession in the family firm: The inheritor's view. Journal of Small Business Management, 24(3): 36-43. 1986

- Fairlie, R. Robb, A. Families, Human Capital, and Small Business: Evidence from the Characteristics of Business Owners Survey. ILR Review, Vol. 60, No. 2, pg. 225-245. 2007

- Gai, Y. Minniti, M. External Financing and the Survival of Black-Owned Start-Ups in the US. Eastern Economic Journal, Vol. 41, No. 3, pg. 387-410. 2015

- IFC. Manual i IFC per qeverisjen e biznesit familjar. 2007

- Kets de Vries, M. The dynamics of family-controlled firms: The good news and the bad news. Organizational Dynamics, 21(3): 59-68. 1993

- Lee, K. Lim, G. Lim, W. Family Business Succession: Appropriation Risk and Choice of Successor. Source: The Academy of Management Review, Vol. 28, No. 4. pg. 657-666. Oct. 2003

- Leka, B. Shkurti, R. Characteristics of family businesses in Albania – a statistical study. Revista Tinerilor Economisti (The Young Economists Journal),vol. 1, issue 14, 168-177. 2010

- Miller, D. Some organizational consequences of CEO succession. Academy of Management Journal, 36: 644- 659. 1993

- Morris, M. H., Williams, R. O., Jeffrey, A., & Avila, R. A. Correlates of success in family business transitions. Journal of Business Venturing, 12: 385-401. 1997

- Ocasio, W. Institutionalized action and corporate governance: The reliance on rules of CEO succession. Ad- ministrative Science Quarterly, 44: 384-416. 1999

- Pitcher, P., Cherim, S., & Kisfalvi, V. CEO succession research: Methodological bridges over troubled waters. Strategic Management Journal, 21: 625-648. 2000

- Williams, D. Zorn, M. Crook, R. Combs, J. Passing the Torch: Factors Influencing Transgenerational Intent in Family Firms. Family Relations, July 2013, Vol. 62, No. 3, pg. 415-428. 2013