Behavioral distortions of private investors: the influence of the news background and the "crowd effect" on trading results

Authors

Nikonov Artem Igorevich

Share

Annotation

This article discusses behavioral errors that can occur among private investors. It explains how the news background and the "crowd effect" affect their investment decisions and trading results. The research is based on the ideas of behavioral finance and prospect theory, which explain why investors' behavior often differs from how they would behave if they were completely rational. The article shows that in conditions of a large amount of information and a high speed of its distribution, news plays not only an informational, but also a behavioral role. They shape public opinion, enhance short-term reactions, and increase the likelihood of impulsive trades. Special attention is paid to "herd behavior", a mechanism of social imitation and information cascades that leads people to make decisions based on the actions of the majority. This can cause price distortions, increased volatility, and increased trading costs. Based on the analysis of scientific approaches, the main channels of influence of news and collective sentiments on the activity and risk of private investors have been identified. Practical recommendations have been formulated to help reduce the negative impact of cognitive errors and social factors. These recommendations include regulating investment decisions, limiting excessive trading, and increasing criticality to information sources.

Keywords

Authors

Nikonov Artem Igorevich

Share

Relevance of the study

In modern financial markets, the behavior of a mass investor plays an important role. His decisions are often made in conditions of information overload, high uncertainty and emotional pressure. Unlike classical financial theory, which assumes rational behavior of participants, trading practice shows that private investors often rely not only on fundamental indicators and formalized risk assessments, but also on the interpretation of news, public expectations, opinions of opinion leaders and signals from the social and communication environment. This makes them vulnerable to systematic cognitive errors such as the accessibility effect, overconfidence, overreaction to news, and other distortions that directly affect the results of transactions and the level of accepted risk.

The study is becoming particularly relevant due to the growing influence of the news background and digital channels of information dissemination. News and comments spread at lightning speed, and their emotional coloring and "competitive" presentation can cause short-term spikes in supply and demand, increase volatility, and push for impulsive decisions. In such conditions, the crowd effect manifests itself as a mechanism of "imitation": investors are guided by the actions of the majority or by external signs of the popularity of an idea. This can lead to information cascades, short-term price distortions and, in some cases, the formation of local "bubbles". For a private investor, this means an increase in the likelihood of buying overvalued assets, an untimely exit from a position and an increase in trading costs due to the increased frequency of transactions.

The practical significance of this topic lies in the fact that understanding behavioral mechanisms helps to improve the quality of financial decisions and reduce losses that arise not from market factors, but from errors in information perception and social influence. The scientific relevance of this topic is due to the need for a deeper understanding of how news impulses and collective behavioral reactions transform into measurable trading results. This is important for the further development of behavioral finance and the creation of applied models for assessing investor behavior.

The purpose of the study

The purpose of this study is to understand and explain the mechanisms that influence the investment behavior of private investors and the results of their trading. We will also offer practical recommendations that will help reduce the negative impact of behavioral factors on the quality of investment decisions.

Materials and research methods

The research was based on the provisions and conclusions of scientific papers on behavioral finance and economic psychology. In addition, we used publicly available empirical methods used in the academic literature to measure the attention and collective behavior of investors.

Various methods were used in the work: theoretical analysis and generalization of scientific data, comparative analysis of approaches to classifying behavioral distortions, as well as conceptual modeling of cause-and-effect relationships between information impulses, social influence and trading decisions.

The results of the study

The emergence of behavioral finance was driven by criticism of classical and neoclassical financial theory, which are based on the idea of the rationality of economic agents and their ability to process all available information without any systematic errors. Observations of the behavior of stock market participants have shown that investors' real decisions often do not correspond to the rational choice model. These deviations are persistent and are explained by limited rationality, emotional reactions and peculiarities of perception of risk and information. An important contribution to the theoretical substantiation of this approach has been made by the research of psychologists and economists, especially the work of Daniel Kahneman and Amos Tversky, who initiated the analysis of systematic cognitive distortions in conditions of uncertainty [3].

One of the key theoretical aspects of behavioral finance is prospect theory, which describes how private investors assess risks and benefits. According to this theory, people react more acutely to losses than to similar-sized acquisitions. This leads to an asymmetric perception of risk. In practice, this manifests itself in an unwillingness to fix losses and retain unprofitable assets, as well as in premature profit taking on growing instruments. For private investors, who usually do not have professional analytical support, such behavioral reactions can have a significant impact on the portfolio structure and final financial results.

In scientific papers, behavioral distortions are usually defined as a set of persistent errors that occur during information processing and decision-making. These distortions develop under the influence of cognitive heuristics — simple rules that allow you to quickly respond to changes in the environment, but do not always lead to optimal results. In the context of investment activity, such distortions as the effect of overconfidence, the anchor effect, the desire to confirm one's point of view, the effect of information accessibility, and herd behavior are most often mentioned. These phenomena are described in detail in works on behavioral economics and confirmed by the results of laboratory and field studies on the financial markets of different countries.

In order to streamline the theoretical knowledge about behavioral distortions in investing, scientific reviews classify them according to two criteria: by the source of their occurrence and by the mechanism of influence on the investor's decision. The table below shows the most common behavioral distortions that have been identified in open scientific sources and textbooks on behavioral finance.

Table

The main behavioral distortions of private investors and their manifestations in investment activity

|

Behavioral distortion |

Brief description |

A typical manifestation in trading |

|

Excessive confidence |

Reassessing your own knowledge and skills |

Excessive frequency of transactions, ignoring risks |

|

The anchor effect |

Focus on initial information |

Linking to the asset purchase price |

|

The effect of losses |

A stronger reaction to losses than to profits |

Holding unprofitable positions |

|

The accessibility effect |

Estimating probabilities based on easily accessible information |

Reaction to high-profile news |

|

The crowd effect |

Following the actions of the majority |

Asset purchases at the peak of popularity |

A source: author's development

The peculiarities of the manifestation of behavioral distortions among private investors are largely determined by their position in the financial market. Unlike institutional participants, private investors usually rely on publicly available sources of information such as news feeds, analytical reviews, and social media posts. Limited access to professional analytics, less capital, and the lack of formalized risk management procedures make the decision-making process more vulnerable to emotional and social factors. As a result, behavioral distortions become not just random deviations, but a stable element of investment behavior [1].

The news background is one of the most important external factors that influence the investment behavior of private investors. Most non-professional market participants receive information about the state of the economy, companies, and financial instruments from news and media channels. In theory, this is due to the problem of limited attention: an investor cannot simultaneously analyze a large number of assets and a stream of diverse information. Therefore, the "visibility" of the event and the ease of access to it begin to play an important role in decision-making. Thus, the news not only provides information, but also forms the agenda, determining which assets and topics will interest the investor and which will be ignored.

The impact of news on investor behavior can be described using several key mechanisms. Firstly, news increases the likelihood that an investor will pay attention to a particular asset (the effect of attracting attention). Secondly, the tone and way information is presented can influence the perception of risk and expected returns. The same economic facts can be perceived in different ways, depending on how they are presented — as a threat or as an opportunity. Thirdly, the media often selects and focuses on "extreme" events, such as unexpected strong price fluctuations, loud corporate conflicts and harsh statements. This can lead to impulsive reactions and short-term trades that are not always based on fundamental analysis.

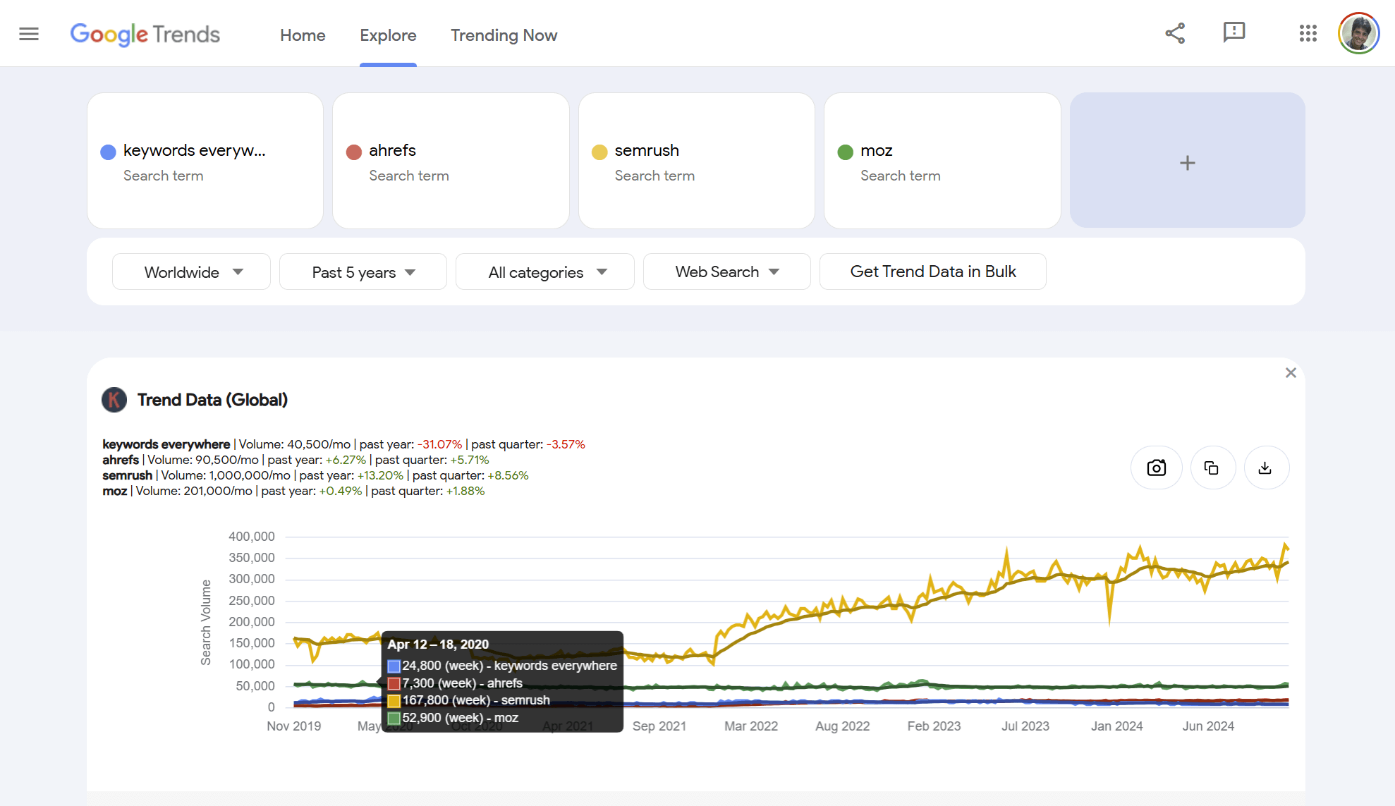

A separate area of research is related to the fact that the appearance of news in the feed does not always indicate the real interest of investors. Therefore, empirical studies use more reliable indicators of audience interest. One of the most well — known methods of measuring attention is the analysis of search activity on the Internet. A study by Da, Engelberg, and Gao suggests using the Google Search Volume Index as an indicator of attention. Based on data from 2004 to 2008, the authors demonstrate that changes in search activity are related to the activity of less experienced retail investors. They also discuss the role of attention in the effects seen at IPOs and in momentum strategies [6].

Below is a picture that explains the principle of this measurement. The indicator is calculated as an index of relative interest that changes over time. This makes it easy to track attention spurts related to various events.

Fig. The dynamics of search interest in keywords in the Google Trends system [4]

In the Tetlock article, the tone of news is considered as an independent factor, since media texts not only convey facts, but also carry an emotional assessment. Based on the daily content of the column "Abreast of the Market" in the Wall Street Journal, the author creates an indicator of "media pessimism" and evaluates its relationship with market parameters. The study shows that a high level of pessimism correlates with downward pressure on prices, followed by a recovery trend. In addition, unusually high or low pessimism values are associated with increased trading volumes. For private investors, this result is important, as it demonstrates that the news environment can affect not only the reassessment of expectations, but also the intensity of trading, which means activity and potential costs [5].

In finance, the "crowd effect" or "herd behavior" (herding) usually refers to a situation where market participants make similar decisions about buying or selling the same assets. This is not because they independently came to the same assessment of fundamental factors, but because they are guided by the actions of other participants, the "general mood" or social signals [2].

It is important to note that outwardly similar actions can be caused by various reasons: from simple imitation and social pressure to a reaction to the general information background, for example, to the same report or macroeconomic news. In market research, it is customary to distinguish between "true" herd behavior and "apparent" similarity of actions due to common factors. A classic example of the formalization of the mechanism of observed learning and the transition to collective choice is presented in the model of information cascades. In this model, the behavior of other market participants becomes a signal that can outweigh the investor's own information.

For private investors, the crowd effect is particularly important for two reasons. First, private investors usually operate in conditions of high information asymmetry, meaning they have less access to professional data and analytics than other market participants do. In such circumstances, social signals such as majority behavior, popularity of ideas, discussions, ratings, and "top buys" have a stronger impact on asset selection and market entry. Secondly, many private investors face attention and time constraints. Therefore, they often make "quick" decisions based on what other market participants are buying, especially during periods of sharp market movements. Empirical studies confirm this by showing increased synchronicity of transactions and increased trading activity at times when attention to an asset increases for external reasons, such as news, price limits, or bursts of discussion.

In scientific research, the "crowd effect" is assessed not based on single observations, but using quantitative indicators. There are two approaches used. The first approach is to measure the "consistency of trading directions" between different groups of participants. For example, it determines what percentage of funds or investors purchase a particular stock in the same period compared to the "normal" share of purchases. This allows you to identify periods of synchronous purchases or sales. The second approach is to measure the "compression" of the spread of individual stock returns relative to market returns. If, during periods of strong market fluctuations, securities yields begin to move "more uniformly," see this as a sign of herd behavior, since individual valuations are replaced by a collective reaction. Both of these approaches are widely used in the international literature and make it possible to relate the "crowd effect" to market phases, liquidity, and future returns.

The impact of herd behavior on the trading results of private investors can be described through several key aspects. The first one is related to the quality of the market entry price. When many buyers enter the market, the price may temporarily deviate from levels that are consistent with fundamental expectations. This increases the risk that an investor will buy an asset at an inflated price. The second aspect is the increase in volatility and trading costs. When many market participants act at the same time, this increases short-term fluctuations and "makes noise" the signal. As a result, a private investor can make impulsive trades more often and pay more fees and spreads. The third channel is the risk of being forced out of a position. When the mood in the market changes, correlated sales increase the decline and can lead to people selling assets "under the influence of emotions" or due to margin requirements (if leverage is used). At the market level, such effects lead to an acceleration of short-term price fluctuations and possible subsequent returns, when the price partially "rolls back" after the momentum of supply and demand weakens.

The study of the mechanisms of the influence of the news background and the "crowd effect" on the decisions of private investors in the field of trade opens the way to the development of practical recommendations aimed at reducing the negative consequences of behavioral distortions.

First, it is important to develop and follow formalized rules when making investment decisions. Using a pre-defined investment strategy, clear entry and exit criteria, and established risk limits reduces the likelihood of impulsive trades that may be triggered by unexpected news or changes in market sentiment. In addition, the regular portfolio structure and periodic rebalancing help minimize the impact of emotional factors on investment decisions.

The second important aspect is to limit excessive trading activity. Experience shows that too many transactions are often associated with overconfidence and a tendency to react to short-term information signals. The introduction of the "temporary pause" rule before concluding a deal and the analysis of alternative scenarios for the development of the situation make it possible to reduce the likelihood that decisions will be made under the influence of emotions.

The third recommendation is a critical understanding of information sources. Separating factual data and interpretations, using multiple independent sources of information, and focusing on the company's long-term performance can reduce the impact of accessibility and the impact of news delivery methods. The practice of keeping an investment journal, which records the motives of each transaction, helps to identify recurring behavioral errors.

Finally, it is worth noting the importance of improving financial literacy and awareness of one's cognitive limitations. Understanding factors such as a tendency to herd behavior fear of loss, or overconfidence significantly reduces the likelihood that they will manifest themselves without our control.

Conclusions

Thus, the news background and the so-called "crowd effect" are important external factors influencing the behavior of private investors. These factors reinforce the effects of limited attention, emotional interpretation of information, and social imitation. News impulses increase the visibility of assets and stimulate a short-term reaction, while herd behavior can lead to delayed entry into a position, price distortions, increased volatility and trading costs, which together worsen the risk–return ratio. Reducing the impact of behavioral distortions is possible through the formalization of investment rules, risk management discipline, limiting excessive trading activity, critical assessment of information sources and the development of financial literacy, which increases the resilience of investment decisions to information and social impacts.

References:

- Vasyanina I.K. Behavioral finance: investment decisions of individuals [Electronic resource]. – Access mode: https://elar.urfu.ru/bitstream/10995/145153/1/978-5-91256-754-4_2025_006.pdf.

- How to recognize and avoid the "herd instinct" in investments [Electronic resource]. – Access mode:

https://ek-top.ru/articles/finansovaya-gramotnost/avoid-herd-mentality-investing/.

- You can't force: why behavioral economics is needed – all the most interesting things in post-science [Electronic resource]. – Access mode: https://postnauka.org/longreads/156598.

- Google Trends Search Volume – See Search Volume on Google Trends [Electronic resource]. – Access mode:

https://keywordseverywhere.com/google-trends.html.

- Paul C. Tetlock Giving Content to Investor Sentiment: The Role of Media in the Stock Market [Electronic resource]. – Access mode: https://business.columbia.edu/sites/default/files-efs/pubfiles/3097/Tetlock_Media_Sentiment_JF.pdf.

- Zhi Day, Joseph Engelbergz and Pengjie Gaox In Search of Attention [Electronic resource]. – Access mode: https://www2.nber.org/conferences/2009/mms09/Da_Engelberg_Gao.pdf.